Plot-Based

Agricultural Insurance

Agritask enables agricultural insurance companies and reinsurers to use geospatial risk analysis to enhance underwriting, monitoring, claims management, and damage assessment processes.

Accurately profile

agricultural risk

Monitor remotely

Enable smart inspection

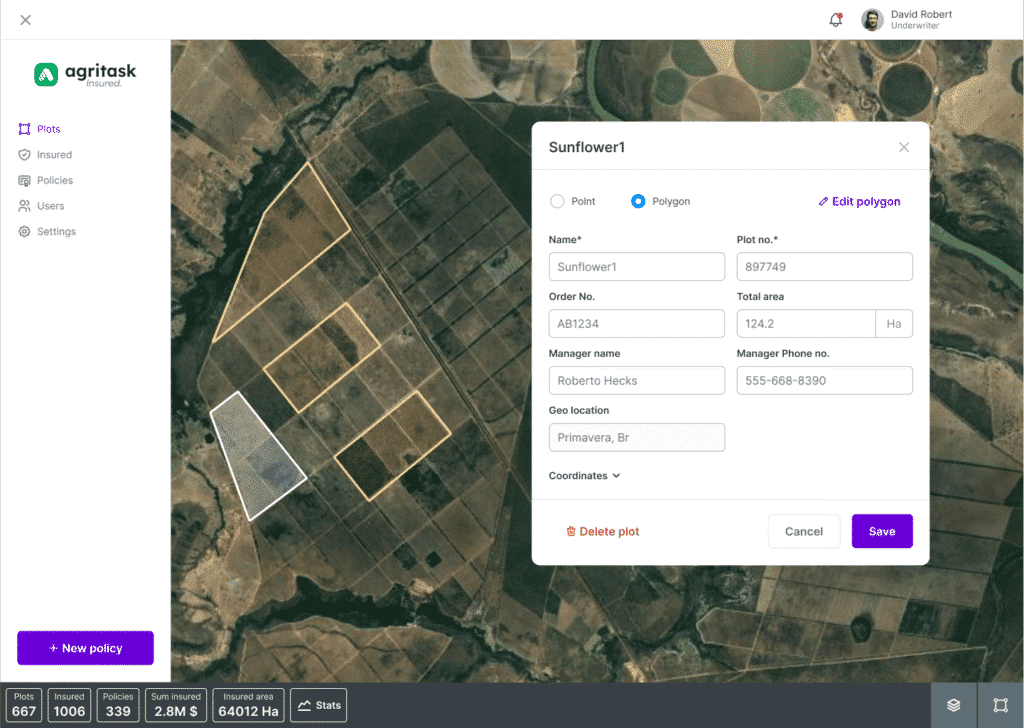

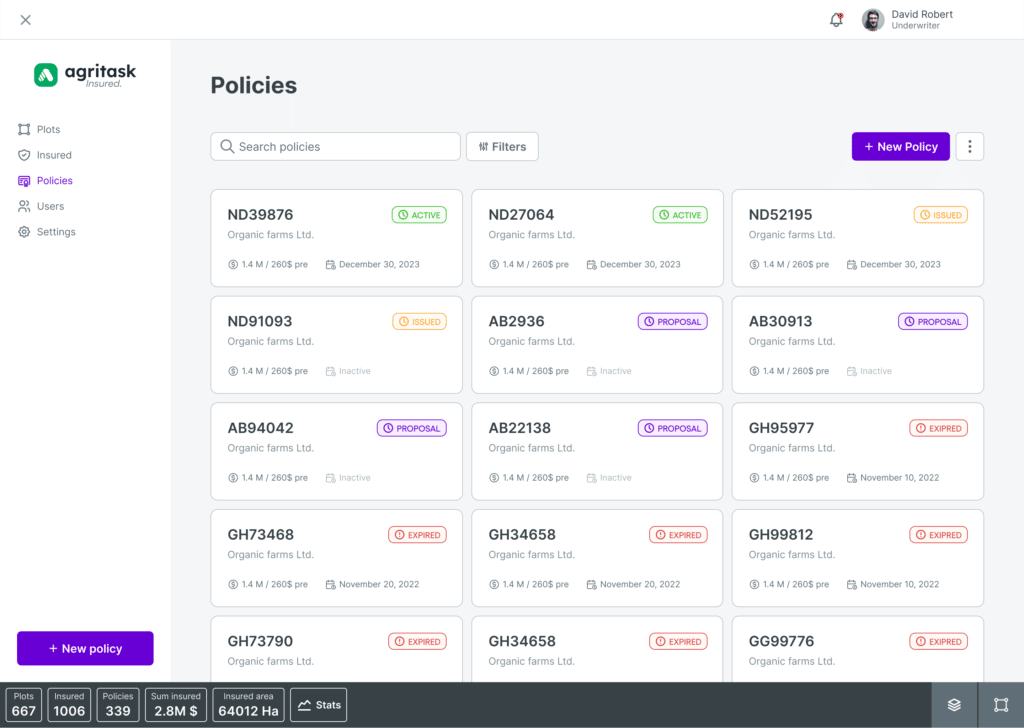

Multi-indicator Plot-level Risk Profiling

Risk-based underwriting for agricultural insurance, making use of multiple geospatial risk data at the plot level.

- Farmer onboarding including polygon registration

- Location-specific risk analysis based on historical risk data specific to each plot

- On-field quotation and historical payout simulation

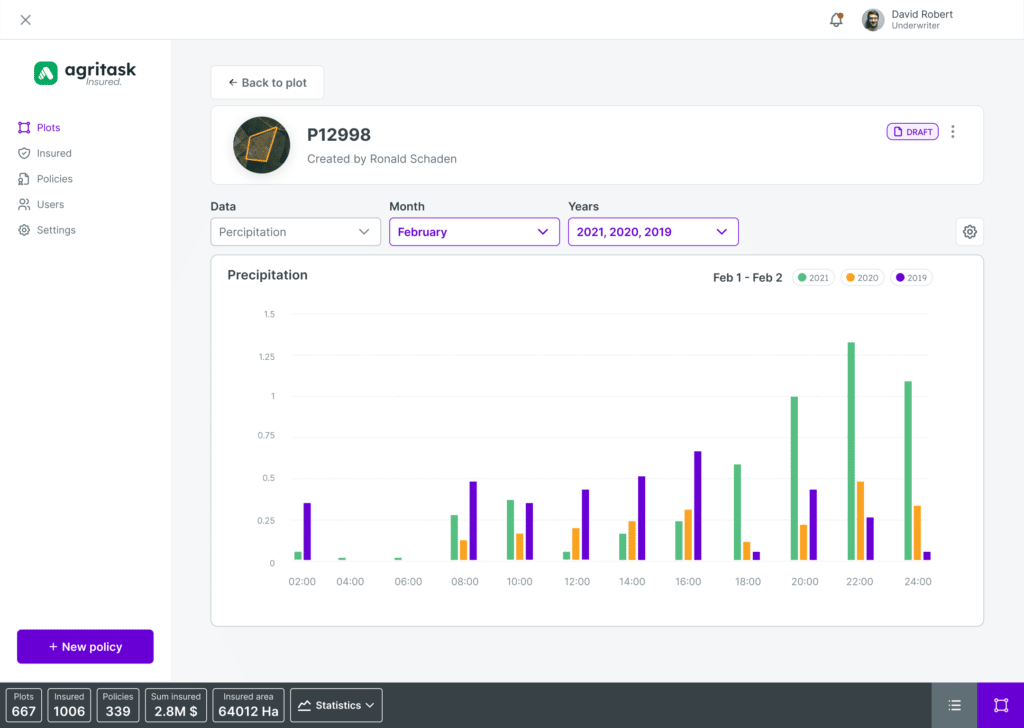

In-season Remote Monitoring

Get ahead of potential claims with real-time visibility into insured plots.

- Real-time satellite and weather monitoring throughout the season

- Alerts of deviations from expected growth and weather patterns to anticipate upcoming claims

- Prioritize field visits where gaps are identified between claims and monitored data

Quality Control Field Inspections

Accurate, timely data flow from field inspection teams to

streamline compliance check and claims management.

- Digitized field inspection protocols such as damage assessment and yield estimation

- Managing field inspection activities including task and route assignments and receiving location and timestamp per visit

- Option for growers to submit claims directly from the app, while receiving additional value from insurers, such as remote sensing data

Agronomic Intelligence Can Transform Your Business

Agritask has been revolutionizing agricultural insurance around the world.

Our experts would love to show you how

Expert Insights from the Ground Up

The Agri-Insurance Conundrum

Agricultural insurance has been trailing behind in its ability to provide personalized underwriting and accurate risk assessments. As a result, the people most in need of insurance are unable to afford it.

Is it simply a matter of finding the right tools?